Maximizing Returns: The Best Time to Invest in Binghatti Off-Plan Projects UAE

When to Invest for Maximum Return

The optimal time to invest in a Binghatti off-plan project depends on your financial goal: capital appreciation or immediate rental income.

For Maximum Capital Gain: The best time is during the Pre-Launch or Launch Phase (Phase 1). This secures the lowest initial price, the widest selection of prime units, and maximum potential profit appreciation leading up to handover.

For Immediate Rental Income: The best time is during the Handover Phase (Phase 3). This allows you to immediately place the unit on the rental market, leveraging Dubai’s strong current rental yields.

Key market indicators suggest Late 2025/Early 2026 presents a strong investment window, driven by sustained population growth and limited prime inventory in key Binghatti locations like JVC and Business Bay.

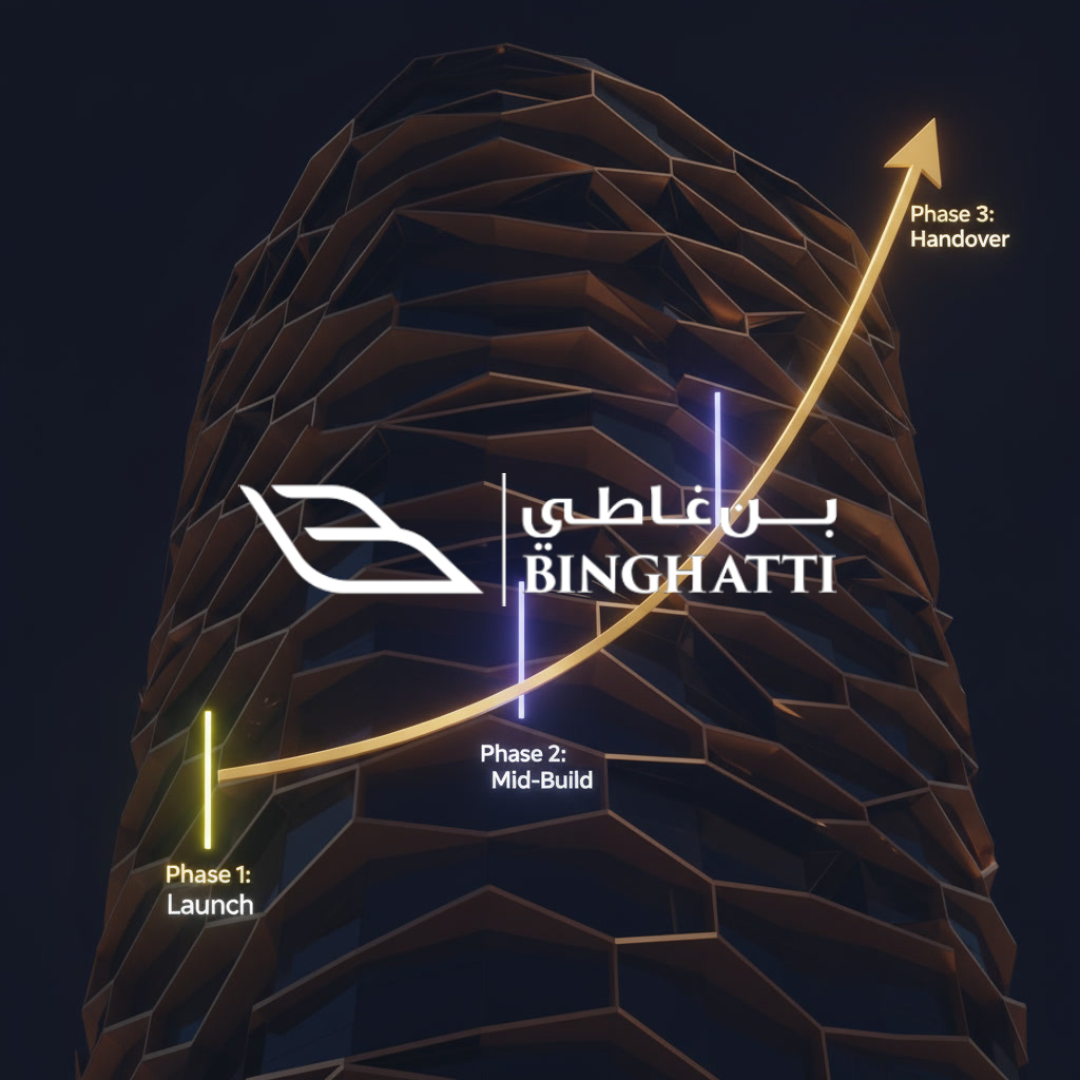

Phase-by-Phase Investment Strategy for Binghatti Off-Plan

Understanding the property development lifecycle is crucial for maximizing returns. Binghatti projects, known for their distinctive design and strategic locations, often follow predictable price appreciation curves across three main phases.

Phase 1: Pre-Launch and Launch (Maximum Capital Gain Potential)

This phase represents the highest potential for capital appreciation, often offering the most flexible and enticing payment plans.

| Advantage | Benefit to Investor |

| Lowest Price Point | Secures the unit at the developer’s minimum introductory price, maximizing the price differential to the handover value. |

| Best Unit Selection | Access to prime inventory (higher floors, best views, corner units) that sell out quickly. |

| Developer Incentives | Often includes waived DLD fees or post-handover payment plans, directly reducing initial investment cost. |

Strategy: Ideal for investors with a 3-5 year holding period who are comfortable with the initial risk of a project still in its conceptual stages.

Phase 2: Mid-Construction (Balanced Risk & Price Appreciation)

Mid-construction typically begins when the structure is visibly rising and the project is nearing 50% completion.

Risk Reduction: The successful commencement and progress of construction reduce the initial project risk, offering reassurance to more cautious investors.

Price Increase: The unit price will be higher than the launch phase, reflecting the progress and reduced risk.

Payment Plan Adjustments: Payment terms may become less flexible, with developers requiring larger milestone payments tied to construction completion percentages.

Strategy: Suitable for investors who missed the launch but still want significant appreciation with a verified construction timeline.

Phase 3: Handover (Immediate Rental Income and Higher Liquidity)

The handover phase is when the property is complete, and the title deed is issued.

Immediate Income: The investor can instantly list the property for rent, generating immediate cash flow and benefiting from Dubai’s currently strong rental market [cite: DLD Q3 2025 Rental Report].

Liquidity: The property is now “ready-to-move,” making it more appealing to end-users and increasing its overall market liquidity.

Highest Price Point: The price reflects the property’s finished condition, eliminating construction risk. Capital appreciation potential from this point onward is driven solely by the general market cycle.

Strategy: Best for investors seeking instant cash flow and a low-risk entry, willing to accept a lower capital appreciation percentage compared to the launch phase.

Key Market Indicators: Is the UAE Real Estate Market Favorable Now?

For any investment in Binghatti, the broader economic context of Dubai and the UAE must be considered.

Dubai Rental Yield Analysis

Rental yields in Dubai have remained robust, especially in the affordable luxury and mid-market segments where many Binghatti projects are located (e.g., JVC, DSO). Strong population influx and the success of the 10-year Golden Visa program continue to drive demand. High rental yields directly support the exit strategy for off-plan investors [cite: CoreSavills 2025 Market Outlook].

Interest Rate Environment and Mortgage Conditions

While global interest rates have fluctuated, the UAE’s real estate lending environment remains competitive. For off-plan, Binghatti’s proprietary payment plans (often 70/30 or 60/40) often negate the immediate need for a mortgage, making the investment less sensitive to interest rate hikes during the construction phase.

Infrastructure Projects and Location

Binghatti is strategic in choosing locations near key infrastructure. Projects in areas benefiting from new metro extensions or proximity to major business hubs (like the proposed expansion near Jaddaf Waterfront) are likely to see faster capital appreciation as infrastructure completion often acts as a major price catalyst.

Deep Dive: Top Binghatti Off-Plan Projects for Investment ROI

When selecting a Binghatti project, focus on locations that have proven supply-demand balance:

| Location | Typical Unit Type | Expected ROI Driver |

| Jumeirah Village Circle (JVC) | Studios, 1-Bedrooms | High rental yield and consistent demand from young professionals and families. |

| Business Bay | 1-Bedrooms, Luxury Branded | Prestige address and proximity to Downtown/DIFC, driving higher capital value. |

| Dubai Silicon Oasis (DSO) | Studios, Small 1-Bedrooms | Affordability and tenant pool from academic and tech communities. |

Frequently Asked Questions (FAQ)

What are the typical Binghatti payment plans for off-plan?

Binghatti is known for offering investor-friendly payment plans, such as 70% during construction and 30% upon handover, or sometimes even post-handover payment plans (e.g., 50% during construction, 10% on handover, and 40% paid over 1-2 years post-handover). This minimizes the initial cash outlay.

Which Binghatti location offers the best rental yield: JVC or Business Bay?

Historically, JVC projects tend to offer a higher net rental yield percentage due to lower capital values and consistently high tenant demand. Business Bay offers higher overall rent value and capital appreciation but often a slightly lower yield percentage due to the premium cost per square foot.

How much is the initial down payment for a Binghatti off-plan unit?

The initial down payment usually ranges from 10% to 20% of the total property value, required to reserve the unit and sign the initial Sales Purchase Agreement (SPA).

Binghatti Investment Resources

To complete your investment research, explore our comprehensive guides on Binghatti’s projects, reputation, and management.

Developer & Market Reputation

What is the reputation of Binghatti Developers in the Dubai real estate market?

Who is the owner of Binghatti Developers and what is their professional background?

What is the quality of community management at Binghatti properties?

What Hussin Binghatti built his wealth primarily by founding and expanding Binghatti Developers

Project-Specific & Ready-to-Move Information

Luxury & Flagship Projects (Burj Binghatti Jacob & Co Residences)

What makes Burj Binghatti Jacob & Co Residences the tallest residential building in the world?

Where is Burj Binghatti Jacob & Co Residences located in Dubai?

What types of residential units are available in Burj Binghatti Jacob & Co?

Who are the developers behind Burj Binghatti Jacob & Co Residences?

What is the expected completion date for Burj Binghatti Jacob & Co Residences?

What payment plans are available for purchasing units in Burj Binghatti Jacob & Co?

What luxury amenities can residents expect in Burj Binghatti Jacob & Co Residences?

How does Burj Binghatti Jacob & Co compare to other luxury developments in Dubai?

Is Burj Binghatti Jacob & Co Residences a good investment opportunity?

How can I purchase a unit or get more information about Burj Binghatti Jacob & Co Residences?